This year’s National Student Money Survey was answered by more than 2,300 university students: huge thanks to everyone who took part!

This year’s National Student Money Survey was answered by more than 2,300 university students: huge thanks to everyone who took part!We now have a candid snapshot of uni life and student money across the UK. Some of what we uncovered is worrying, and some is ripe for government intervention – but the rest is testament to how students persevere when the odds are against them.

To anyone who’s ever been frustrated by unfair stereotypes about students, these stats are for you: read ‘em, share ‘em, and – most of all – use ‘em to kick-start an action plan.

What's on this page?

What's it like living on a student budget?

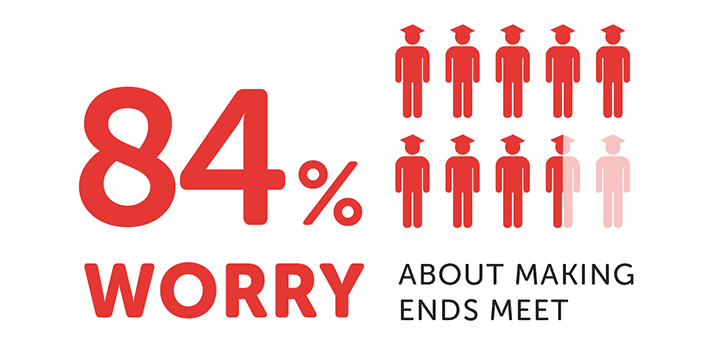

More students than ever are stressed about money. Almost all of you (84%) say you worry about having enough to live on (that's up from 80% in 2016). Lack of cash even affects how well you eat, and whether or not you can stay on top of your studies.

Money and mental health

This

year the survey probed into what effect money has on student well

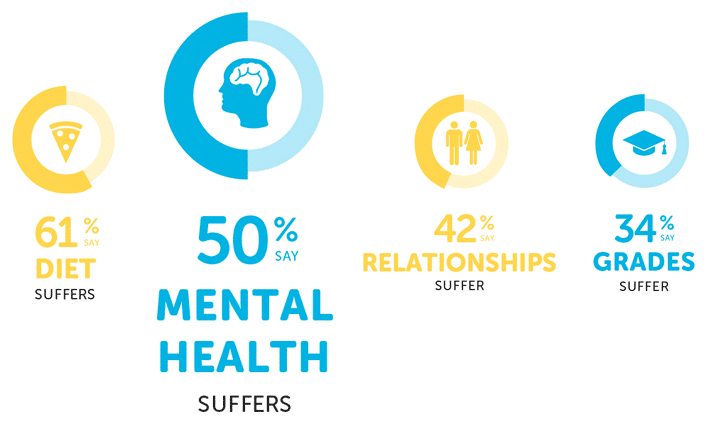

being. Worryingly, half of all students said they’d experienced mental health issues as a result of money problems, with 42% also saying hardship takes a toll on relationships with friends and family. Perhaps unsurprisingly, we received lots comments saying being poor at uni can be a lonely experience.

This

year the survey probed into what effect money has on student well

being. Worryingly, half of all students said they’d experienced mental health issues as a result of money problems, with 42% also saying hardship takes a toll on relationships with friends and family. Perhaps unsurprisingly, we received lots comments saying being poor at uni can be a lonely experience.I ended up feeling really isolated from my new friends because I never had any money to go out and do the things every fresher does.Just as concerning is the link between wealth and well being. Students who reported mental health problems were more likely to say they didn't get enough financial education before uni, or enough financial support from parents once they started their course – and it can be a bit Catch-22.

Mental health charity Student Minds say:

Financial worries can increase mental health difficulties and experiencing mental health difficulties can worsen ability to take care of finances.Asking for help can be tough sometimes, but don't forget there are organisations which exist purely to support students: start with the ones listed here.

Student comments

– Student life is constantly a battle between surviving and eating and getting an education

– All my money goes on rent, I have no money to socialise or even sometimes eat. It's not just a little bit of money I have to pay toward rent it's as much as £700 each payment along with my maintenance loan

– At one point this year I spent over two weeks living solely off things that I had in the house already (tins and freezer food). After this point it became almost obsessive and I wouldn't go to the shops and do a weekly food shop … teenagers should be taught how to save and spend money in ways that are not destructive

– Student life is poverty but the experience and degree is worth the stress

– I feel the older generation don’t really appreciate how hard it is to get by as a student

– I've had to take out additional loans to cover expenses this year

– Trying to think of how on earth I'm going to find the money to do this degree when I can't get a loan has been a big cause of my panic attacks

– You make so many friends and grow as a person whilst at University, but I think not enough preparation is done to prepare students for what they'll be going into … it all seems a bit like some amazing fantasy place to go when in reality it actually involves a lot of hard work and dedication!

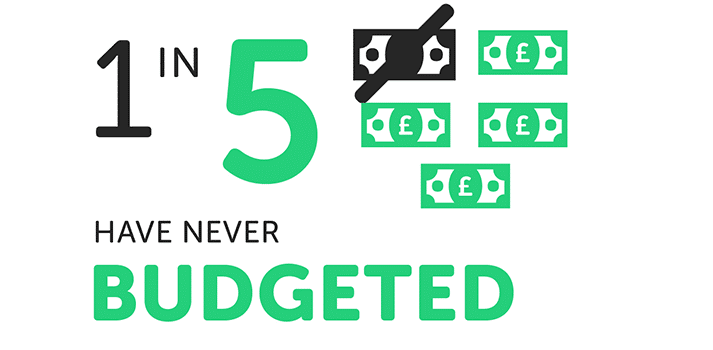

1 in 5 students don’t track their income and outgoings – which means not having a clear picture of how much cash you have now, and whether it'll cover future expenses. On the other hand, 80% of you have cottoned on to how easy budgeting is.

Unfortunately, we found the one thing that can penetrate even the sturdiest of budgets is not earning enough money to start off with. Now, most adults have a few more options with this: find a better paying job or apply for benefits. Both of these options are more limited for full-time students, and moreover the Student Loan leaves you under-funded from day one…

The Maintenance Loan STILL isn't enough

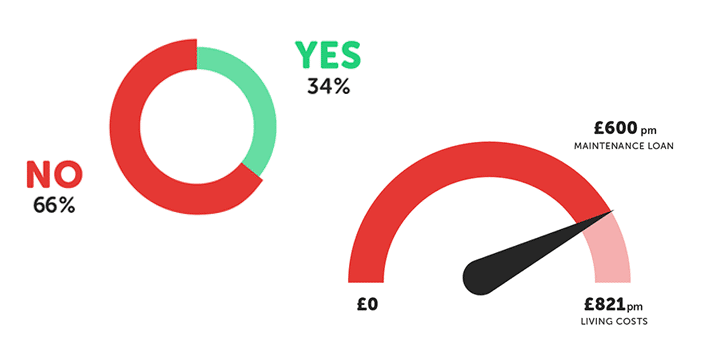

We bang on about this every year because, every year, students tell us the Maintenance Loan leaves them struggling to get by. In fact, if you take a look at the gauge above, you’ll see the average monthly maintenance instalment can be as much as £221 short of what students need to live on (full stats here). Which begs the question: where does the government think students magic the extra cash from?

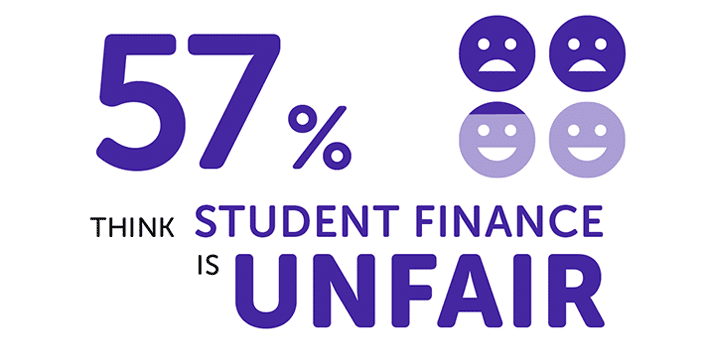

Unsurprisingly, lots of students think Student Finance isn’t fit for purpose. Loads of you also say it’s not fair to expect family budgets to pick up the slack – especially when some parents send more than one kid to uni, or are doing their best to cover household costs as it is.

Student maintenance loans should take into account the price of your rent, and it should cover your rent with some left over for food, in case a student cannot rely on parents for funds.

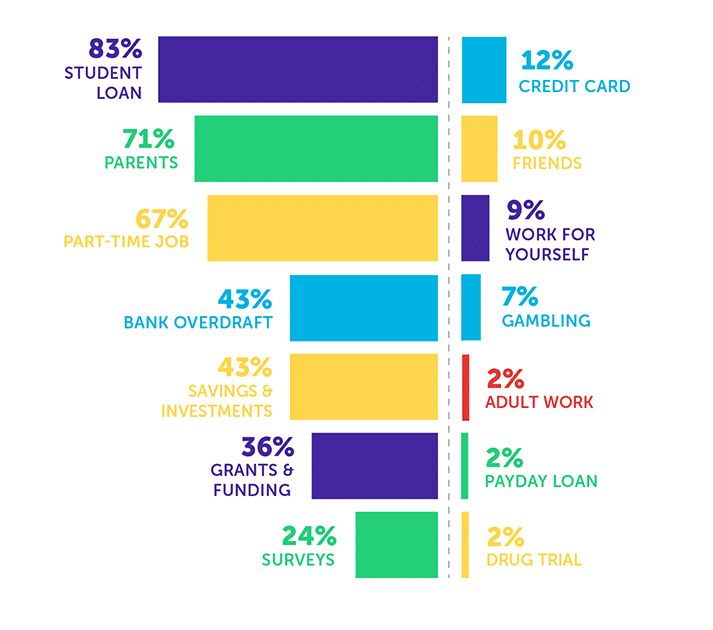

Where do students get their money?

Short of magic money trees and Lotto wins, we wanted to know where students find the money for everyday living costs. Here's what you told us.

Parents are likely to be feeling the pinch around now, with 71% of students relying on money from their folks to make ends meet (up from 69% in 2016). This is such a huge issue that we created a parental contribution calculator which shows how much parents should be helping their child(ren) out at uni.

More students than 2016 also say they work for themselves: self-employment is an obvious fix for a lack of local jobs or heavy study commitments, so we wouldn't be surprised to see this continue to climb. The Student Loan remains the go-to for uni cash – which is why not having enough of it can cause serious problems.

As predicted last year, the pressures of covering costs and limited income opportunities means a small number of students continue to rely on gambling and adult work as ways to make money.

• Also see 37 weird ways students make money

What about savings?

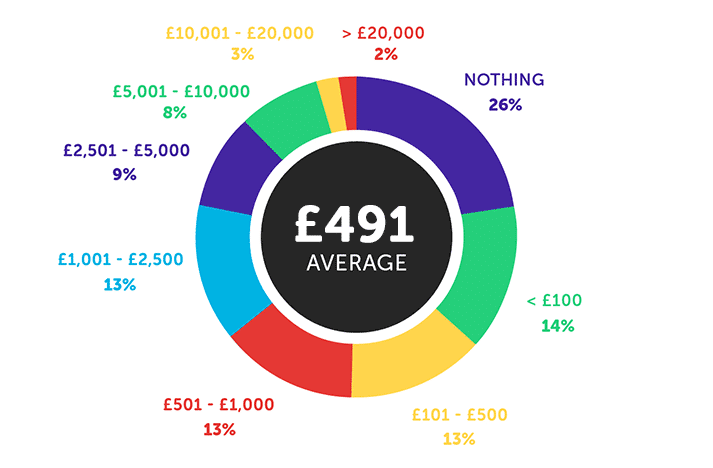

Finding extra cash to put aside is a tough ask for many students: 40% of you have less than £100 in savings … but almost a third have absolutely zilch.

The good news: well over a third of you (39%) have up to £2,500 stuffed into savings. The less brilliant news is that amounts vary massively, so some of you still have just a hundred quid to fall back on by the end of the academic year (just when you need money for summer, and less Student Loan to pay for it!).

Interestingly, we didn't find many tech-savvy savers: 91% of you DON'T use apps to track or boost your savings, with lots of you saying you just haven't heard about them.

Get over to our automatic savings apps guide to see why apps mean less effort (and how they can give you extra cash for free!).

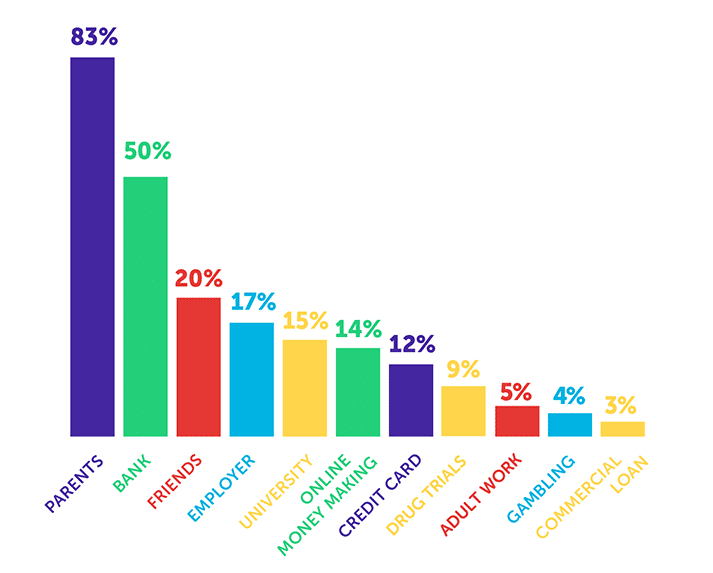

Where do students turn in a cash crisis?

When you live on very little, even small set-backs can cause big problems. We wanted to know where students turn when things don't go to plan.

Once again, parents are a lifeline for most students, with half of you also turning to your bank for overdrafts or loans. Despite having hardship funds in place, few students (just 17%) can squeeze cash from their uni in times of need.

Here's also where see a small rise in the number of students – of all genders – who turn to adult work like webcamming, sugar dating, fetish requests and sex to cover their costs.

I am on the disability register at university. As far as money goes, I don't qualify for a bursary or anything, so i'm not sure what extra help there is.While the Bank of Mum and Dad remains a top stop for income at any time of the year…

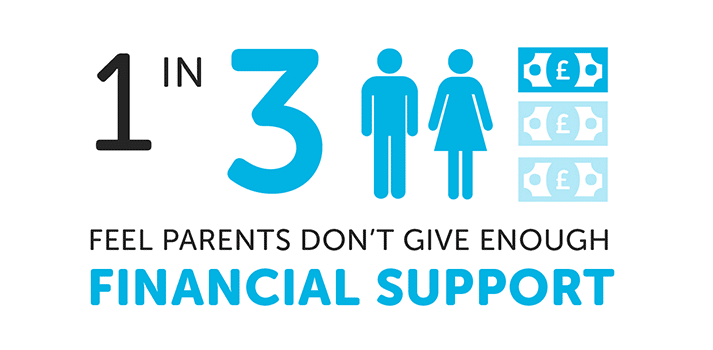

The parental contribution is always going to be a thorny issue, with a third of students saying they don't get enough financial support. Loads of you also feel hard done-by on behalf of your folks, saying uni costs strain family finances and make you feel guilty about asking for help.

If it's a loan you have to pay back, why can't you borrow what you really need to get by? And why should your parents' income dictate how much support you get? We hear what you're saying; we're waiting for the government to listen up, too.

Student comments

– There should be a student loan payment to cover the summer months … as having parents with income doesn't mean they'll pay for your summer (or for anything for that matter), and in some university cities finding employment in the summer can be difficult due to the large amount of students looking for part-time work

– My student loan doesn't even cover my rent by about £1000, I work at least 16 hours a week, and I'm still trying to pay off my overdraft

– The government expect parents to support their children on a monthly basis, but I could never accept money from my parents even if they could afford it – they have two other children to support

– I was left scraping for pennies at the bottom of my overdraft when one of my friends whose parents earned less was able to spend lots of money on unnecessary things because she got lots of grant and loan

How far do students go to make or save money?

With so many of you telling us the sums just don't add up, we were keen to hear just how you plug the gaps.Student comments

– Lived on cream cheese and crackers for 2 weeks during exams

– Shower at the gym

– Selling shoes to foot fettishest

– Use Subcard points to help feed the poor then accidentally got an award for it

– Bought clothes, worn and returned

– Shower in the dark to avoid turning on lights

– Stayed at the library for long hours after university even when I didn't need to/ feel like it to save on electricity/ water at home

– Take small amounts of food from other people when possible

– Doubled toilet paper by separating it.

What do students spend their money on?

Time for the big one: finding out where all the money goes!

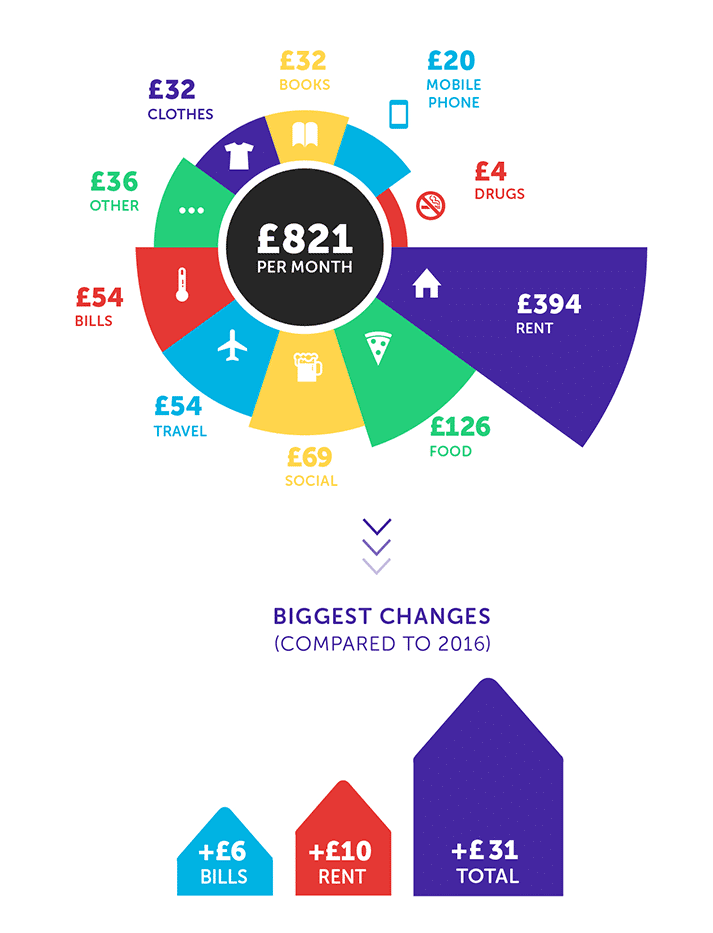

The average student monthly spend is now £821 – that's up by £31 from this time last year. Rent is the biggest gobbler of finances, accounting for almost half of the total – and probably a lot more than you get in Maintenance cash! If that wasn't bad enough, the real strain comes at the start of term, when students are expected to hand over big money for rent in advance.

One cost that might take you by surprise is just how much you have to fork out for your course every month: from books and printing to stationery and course-specific materials, it ain't cheap!

I don't understand why we get money termly rather than monthly considering that this is not true to life. Also means if you screw up with the money you have nothing till the next term

Do students understand their loans?

Taking out the student loan is a bit like getting a mortgage: a substantial amount of money that you'll be paying back for a long (long) time. So: do you know what you've signed up for?

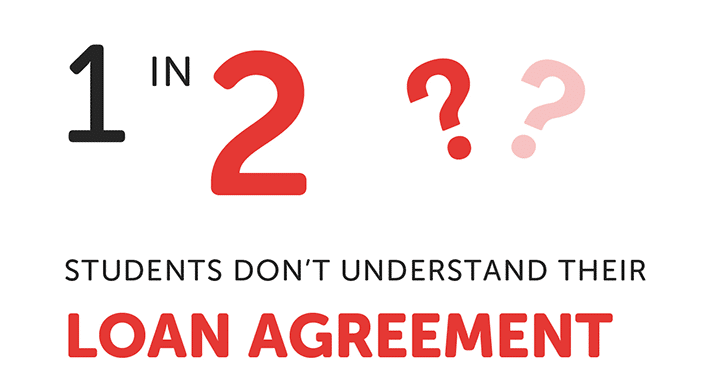

In a word: no. Half of you told us you don't understand your loan agreement or the repayment terms. Not only does that put you on the back foot, it can mean extra (and, at times, unnecessary) stress. In fact, 3 in 5 of you say you worry about paying back the loan – even though you'll only pay when and if your salary is above an earnings threshhold.

The terms of student loan changed while I was at uni, very unfair. During my UG I was told they wouldnt count to getting a mortgage now they will…

It's worth saying that the Student Loan is pretty favourable to students, all things considered. But, by not checking the small print, you may miss the fact that the terms can change at any time, or won't know how much interest you loan's accruing. Speaking of which…

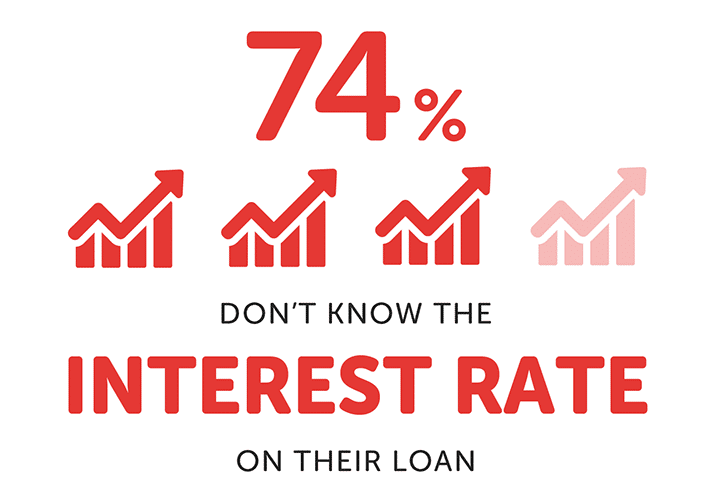

A whopping three-quarters of you don't know how much interest your loan is brewing behind closed doors (heads-up: it could be much higher this September).

This one comes with a but, however: if you don't earn enough over the course of your career to pay back the whole loan, interest might seem a bit of a moot point. On the other hand, added interest means you'll end up paying more without clearing your balance.

In a nutshell: when you borrow cash from anyone, always find out exactly what you're being charged, when and why!

So, this is either canny thinking by most students – or it's a massive gamble. Most students don't know the ins-and-outs of how the loan works, but then they don't expect to ever pay it all back.

Student comments

– Becoming independent is difficult and the most important thing is balance and also the ability to ask for help from the university, advisers, friends, online help and parentsThere's an awful lot of confusion floating around out there about loans, repayments and not having to pay back the loan when you move abroad. Some of that confusion could be avoided if students learned more about money management at school and university and from parents. Unfortunately … that doesn't happen.

– Who are student finance to determine how much different students get when they only take a handful of circumstances into account?

– Students are being left with crippling amounts of debt without realistic prospects of being able to pay it back

– Everyone deserves to be at uni. Not only the rich.

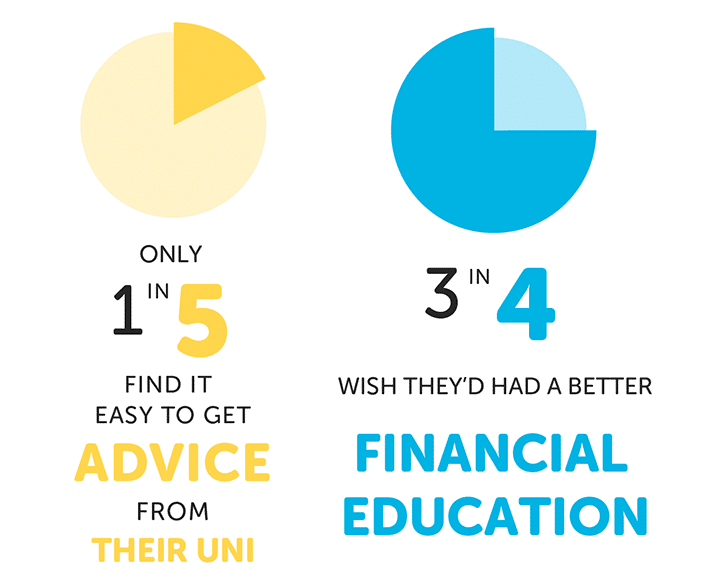

In fact, the majority of students say the opposite: they arrive at uni clueless about money matters and, when things go wrong, getting advice from their university isn't plain sailing. If that's you – and the stats suggest it probably is – what can you do to protect yourself?

The main thing is: don't wait to be told. There's no shortage of information out there, on everything from how much students need to get by, to sources of support when things don't go to plan. Have a look around our site, ask your university's welfare office for reading matter, or hunt out student money resources online. If you're stuck and don't know who to ask, drop us a line in the comments section: we'll do our best to tell you who to hassle!

Is university good value for money?

Our National Student Money Survey doesn't always paint a rosy picture of student finances (we're nothing if not completely honest!). But let's cut to the chase: do students think uni is worth the spend and extra stress?

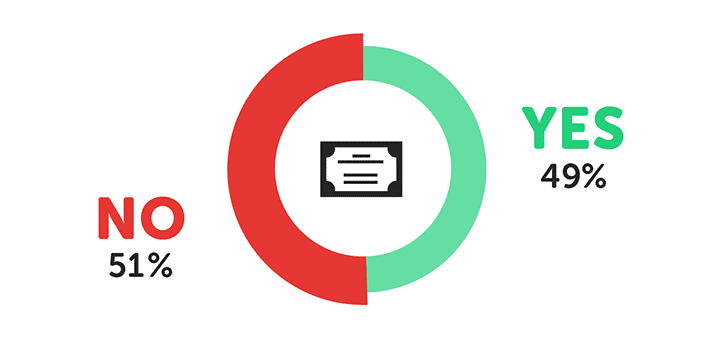

This year's results show an almost equal split among students who think university is worth the cost. Given tuition fees will rise again this year (and could go up each year of your course), just 49% of satisfied customers seems well short of the bar.

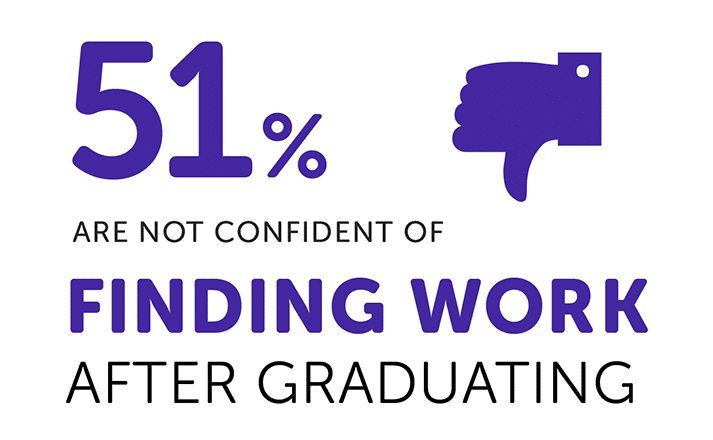

And if you want to understand what that's about, look no further than job prospects – 51% also doubt they'll find work after graduation.

I have just finished uni, having had max amount of student finance but still had to work part time the whole way through to survive. Never had good enough credit score for credit or an overdraft, or enough money to create savings. Now unemployed (past year), not eligible for any benefits because I have a partner (who only works part time) and I haven't had an income, job, or money in the bank for a year. I'm completely disheartened by the system.

Thinking about life after university

Leaving university should mean the start of a new life but, for many students, it's a whole other bag of panic. For one thing, just 49% of you are confident about finding graduate employment: that's exceptionally underwhelming given you've just invested 30+ grand in getting a better job, right?

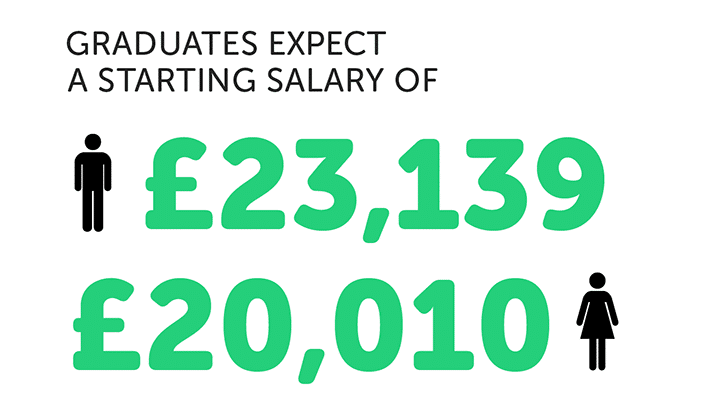

The real sucker punch? The average salary you reckon you'll make in your first job is a sour-faced £20,995 – that's around two grand less than the £23k national average graduates report getting (although male students are much closer to the ball park!).

The

big question is why do students across the board expect so little

remuneration given they're shelling out increasing amounts of cash on a

degree? And, more worrying, why do female students expect to earn less off the bat?

The

big question is why do students across the board expect so little

remuneration given they're shelling out increasing amounts of cash on a

degree? And, more worrying, why do female students expect to earn less off the bat?This might come back to how little students learn about money before uni: from balancing a budget to shopping around for cheaper gas, there are loads of things you're expected to just ‘suck it and see'. That's kind of what's so exciting (and terrifying) about being an adult but, undeniably, when you're feeling your way through life, there's lots of insider info (and income) you're going to miss out on.

University is, and always has been, about more than the cost. It should open the door to new opportunity and experience – but the numbers suggest lots of you are taking a gamble on rising costs and what you get for your money.

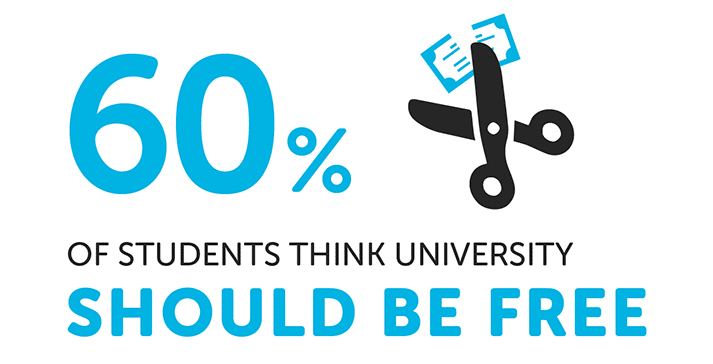

This one might come as a surprise to more than a few politicians (and voters), with a sizable chunk of the student population (40%) not feeling university should be free. We found a much greater understanding of the issues and not as much hippy chic liberalism as the press would have you believe.

[It] shouldn't be free (I don't want taxpayer money spent on something I can pay back rather than NHS etc, especially when a lot of taxpayers could not access uni themselves.) However current costs are too high.Just over half of the student population thinks university should be free, with a roughly 50/50 split among those who said all students should get the same Maintenance Loan irrespective of household income. And, when we asked you to set your own maintenance loan, you came back with a very reasonable £6k. That's actually less than the top whack currently available, suggesting that lots of you are being penalised by family incomes.

So. It's not that students want a free ride: they're more than happy to pay their own way. But do they want a fair ride? Hell yeah. Who wouldn't?

#ref-menu

#ref-menu

No comments:

Post a Comment